AllVida Pension Solution

Take a step towards world-class pension management. Enhance value for your participants.

Specially developed for pension funds, pension insurers and premiepensioeninstellingen, this solution’s fully modular design offers excellent customer service to both participants and employers, as well as efficient and controlled pension management. AllVida comes with a standard set-up and is fully configurable.

AllVida is multi-client and multi-scheme, supporting both the new schemes in the new pension system (Wtp) and the old FTK. Flexible, scalable and robust, you gain innovative opportunities for customer experience and activation. With AllVida Pension Solution, you are at the forefront of the dynamic pension landscape.

%20(1).png)

We are trusted by:

Ready to unlock your world-class pension service?

Choose from one or all modular components: A powerful back-end solution, a user-friendly front-end solution, agreements or process insights. With AllVida, you are set for flexibility and efficiency.

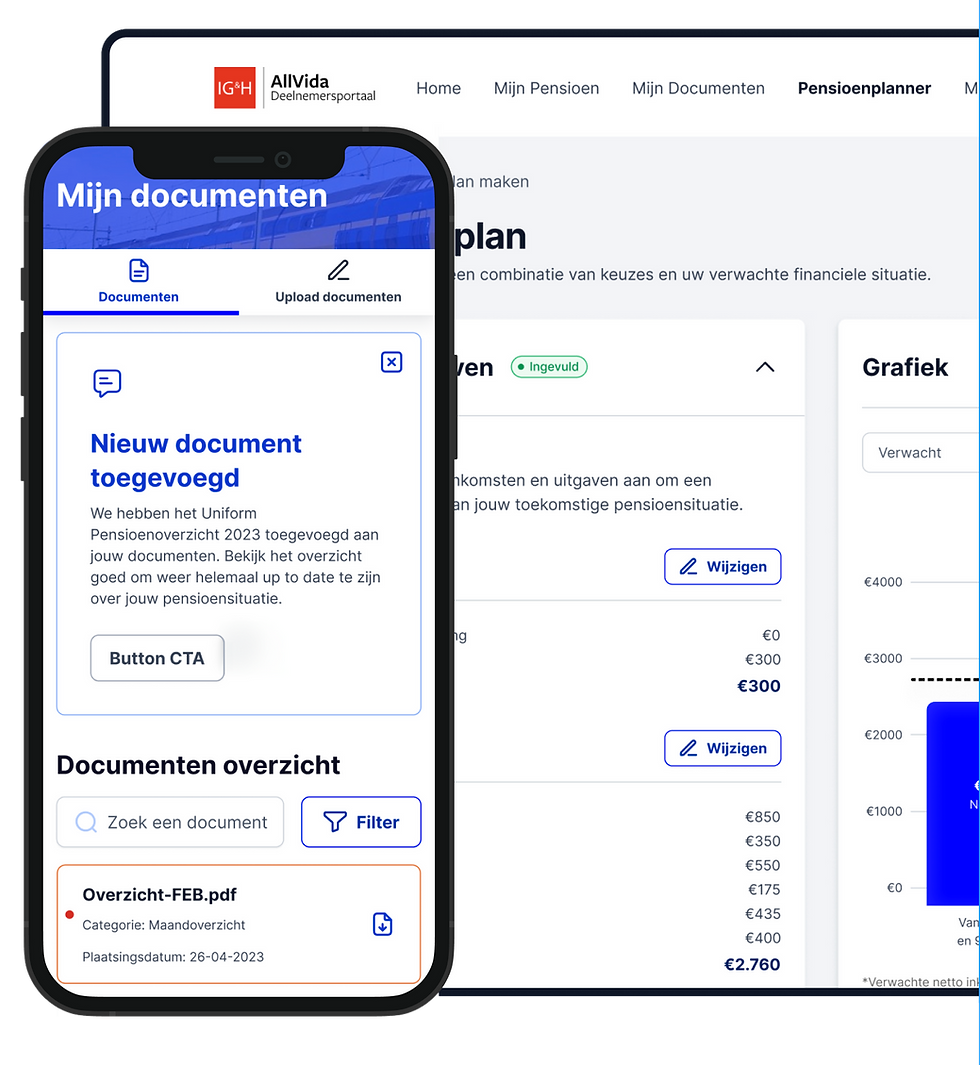

A digital, data-driven, multichannel customer experience for employers and participants. Deliver effective and personalized customer journeys through our integrated front-office solution for portals and customer service, ensuring optimal user experience, automated processes and a design aligned with your organization’s brand.

The back-end ensures secure, scalable, and high-performance processing of pension data. It supports complex pension schemes and integrates easily with external systems and data sources.

Define and execute your proposition based on the organization’s product and services catalogue, to simplify, centralize the management of pension agreements, contracts and quotations. It ensures efficiency, transparency, version control, and compliance.

Real-time oversight of risks, compliance, and operational performance. Pension providers stay in control and can make data-driven decisions with confidence.

Your future pension solution?

As easy as 1, 2, 3

The one-stop shop for pension management from the perspective of participants, employers, and pension funds.

Excellent Customer Service

Design and implementation of a digital, data-driven multichannel customer experience for participants and employers, including a customer experience development strategy, portals, customer journeys, CRM, and data analysis.

WTP-Proof Administration & Transitioning

Realizing WTP-compliant administration and transitioning ("invaren") for pension funds by setting up pension administration systems, including integration with asset management and accountability.

Controlled and Sound Business Operations

Supporting pension funds in designing and implementing a management control system in the areas of governance, risk, and compliance, to ensure healthy and controlled operations.

Full Control Over the Service Chain via PDC

Supporting pension funds and administrators in defining, designing, and executing pension schemes and their implementation based on the Product Service Catalog (PDC).

How AllVida Pension Solution can support you

Agnostic and integration-ready

Ensuring seamless adaptability with full API integration, it offers flexibility to connect with all your existing ecosystems.

Centralized customer agreements

All customer agreements are stored in one place, ensuring consistency across all channels and systems.

Compliant by design

All available options comply with rules and regulations. We offer internal and external reporting functionalities and legal enforcement support.

Built on PDC-model

Customer agreements are built using a structured, reusable model that is easily configurable for scalability to grow without complex customization.

Standard configuration

Start fast with a base setup, and expand easily with additional modules tailored to your needs.

Custom agreements,

standardized approach

Even custom client setups are handled through generic execution, reducing complexity and maintenance.

Frequently asked questions

Ready to transform into a world-class pension service provider?

Roel Palmen

Why accelerate your digital transformation for a seamless transition to the new Dutch pension schemes with IG&H? You can rely on the combination of our market insights, deep pension sector expertise and end-to-end approach powered by modern technology solutions to make your transformation a success.